In just a decade, virtual cards have evolved from a tech

novelty to a powerhouse for travel suppliers. As commercially minded agencies

seek seamless, automated payments, the surge in virtual card transactions is

only set to grow.

The global value of

virtual card transactions will reach $6.8 trillion in 2026, from $1.9 trillion

in 2021. Travel merchants, including airlines, travel advisors, online travel

agencies, tour operators, hotels and car rental companies, are in line to receive

powerful benefits that change how they do business.

Travel agents are one of the most critical stakeholders in

travel. Often, they own the relationship with the traveler who relies on them

for recommendations, convenience and post-booking support. But in managing the

travel supply chain – from airlines to hotels to restaurants to spas – they are

also the guardians of the traveler’s experience. Agencies stand to benefit from virtual cards

that improve travel on the ground and business operations in the office.

What is a virtual card?

In the realm of B2B transactions, virtual card numbers

function as a payment option typically issued for the purpose of paying

a specific amount in a chosen currency to a designated merchant. Every virtual

card is equipped with a unique 16-digit virtual card number a three- or four-digit CVV

number and an expiration date.

Virtual payments allow businesses to issue a unique virtual

card number that stores all transaction data, such as payment information

and purchase details. Because virtual card numbers are digital, travel

intermediaries can organize and manage them in granular ways, unlocking new

capabilities.

When travel buyers,

such as travel agencies, use virtual cards to pay travel suppliers in a

business-to-business transaction, virtual payment solutions allow travel buyers

to obtain virtual cards from multiple issuers through a single integration.

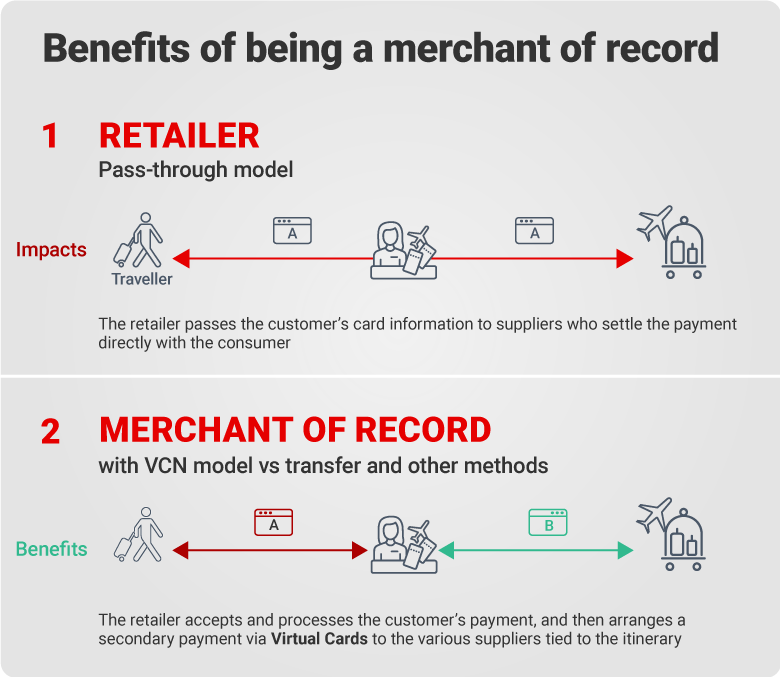

Pass-through vs. merchant of record models

Virtual cards have become a critical conduit for travel providers

as they transition from transaction processors to experience purveyors. Under

the more traditional pass-through model, they act as payment intermediaries,

relaying customer payment information directly to the suppliers involved in the

travel itinerary. In this scenario, challenges can arise, including:

- Risk of fraud as the customer’s credit card details go to

multiple companies. - Risk to the agent’s reputation if the supplier mishandles

the transaction or delays a refund. - Potential delays in receiving agent commissions from

suppliers. - Misalignment between the payment methods available to

customers and those required by suppliers (especially in international travel). - Currency fluctuations that can cause travelers to pay more

than what the travel agency quotes. - Time-consuming payment reconciliation with multiple

suppliers. - Lack of insight into customer spending habits, preferences

and other data.

In contrast, many travel agencies are shifting to a merchant

of record model in which the agency collects all charges due from

clients, authorizes the transactions and pays the travel suppliers tied to the

booking. In this scenario, travel agents

can avert challenges through:

- Reduced risk of fraud as the agent retains the customer’s

credit card details. - Reduced risk to the agent’s reputation by controlling all

transactions and customer refunds. - No delays in receiving commissions from suppliers as the

agent can deduct its commission from supplier payments. - Fewer challenges with payment methods as agencies and

suppliers work out payment issues as part of establishing an ongoing business

relationship. - No impact from currency fluctuations since a virtual card

permits the travel agent to secure an exchange rate at the time of the booking. - Easier supplier payment reconciliation.

- Complete visibility so that travel buyers can easily track

their spending and generate automated reports, which leads to better

decision-making about how to allocate travel budgets.

One of the most significant benefits and unique features of

virtual cards for agencies is enhanced spending control. Travel buyers can

issue virtual cards for specific business-to-business use cases that they can

determine, including:

- Single transactions or specific purchases with a spending

limit. - Multiple transactions within a restricted time frame (for the

period of a business trip, for example). - Payments to one supplier or category of suppliers (for

instance, only hotels or only airlines). - Other payment scenarios with a combination of

restrictions.

Giving travel buyers greater control over payments under the merchant of record model opens the door to deeper relationships with suppliers,

enhanced cash flow, more revenue (travel agencies can offer customers lucrative

buy-now, pay-later plans) and higher

growth. According to Phocuswright and Mastercard, travel agents acting as merchants of record

in the United States posted a 43% compound annual growth rate from 2020 to 2022.

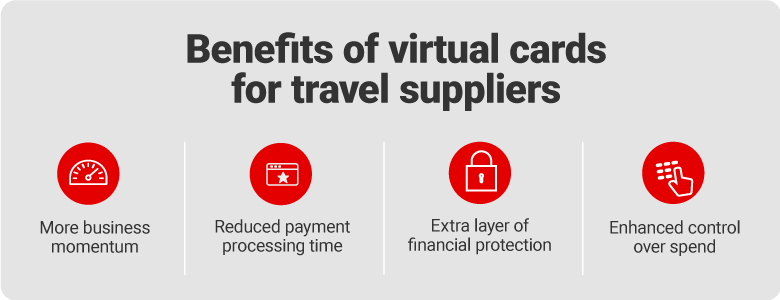

Benefits of virtual cards for travel suppliers

Virtual Payments

open new avenues for merchant of records, empowering them to expand their

business and achieve greater success. The risk of fraud associated with virtual

payments is much lower than with other payment types, including physical credit

cards, checks and wire transfers. Physical card numbers are never revealed to

suppliers, and virtual cards stop functioning when they achieve their goals.

Virtual cards offer merchants an extra layer of financial

protection through guaranteed payments and refunds to travel service providers

on both sides of the transaction. In addition, airlines receive payment from

travel agencies at the time of the booking versus at two-week intervals under

Billing and Settlement Plans.

Virtual payment solutions reduce payment processing time and

effort across the supply chain. For example, virtual transaction reports

automatically match invoices and remittances, which merchants can import into

enterprise resource planning (ERP) and accounting systems to facilitate

reconciliation.

Less payment processing time means merchants and suppliers

receive payments faster, reducing working capital costs and improving cash

flow. Virtual payments lessen the need for merchants and suppliers to track

down late payments or send out reminders and late notices and decrease the

number of accounting and reconciliation errors.

Virtual

cards provide benefits and guarantees across the travel supply chain – to

buyers, such as travel agencies and intermediaries, and also suppliers,

including airlines, hotels, car rental companies and tour operators.

Why airlines should embrace virtual cards

Airlines, especially, benefit from virtual cards. Besides

being a fully secure and flexible payment alternative, virtual cards allow air

carriers to earn additional revenue from travel agencies that have exhausted

their BSP/ARC credit lines.

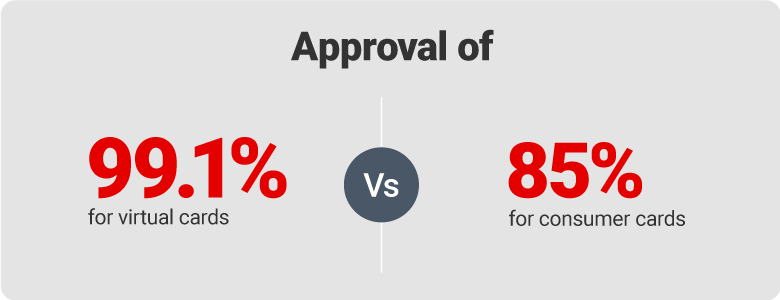

With higher approval

rates – 99.1% for virtual cards versus 85% for consumer cards – and less fraud,

airlines enjoy reduced processing costs and effort.

Virtual payments allow airlines and travel agencies to agree

on different pricing, levels and currencies (as not all relationships are

equal) on some wholesale travel programs from card schemes.

Payments are the connective tissue that binds the travel

ecosystem. And because momentum is moving toward efficient, secure and flexible

business-to-business payments, virtual payments – the operational, security and

competitive benefits of which outweigh the financial costs – are the next step

in the industry’s evolution.

As a leading software and technology provider to the travel

industry, Sabre knows how transformative it is for B2B travel businesses to be

able to consolidate complex processes in comprehensive, end-to-end solutions.

Sabre Virtual Payments, is a fully integrated, multi-channel solution that

allows agencies and travel bookers to select the combination of banks, credit

card schemes and funding solutions that deliver the most value to them and

their business.

*Sabre Virtual Payments product management director Nicolas

Ortiz contributed to this article.

Find out more

Speak to one of Sabre’s experts to discover how

you can accelerate your payments strategy today.