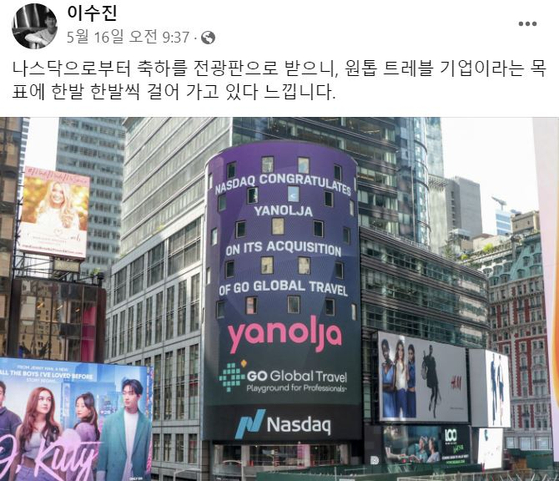

Yanolja’s CEO posted a picture of Yanolja’s digital billboard displayed in New York’s Times Square in his tweet. [JOONGANG ILBO]

Online hotel booking company Yanolja set up a subsidiary in the United States as part of its push to go public.

While Yanolja declined to comment, the company established its wholly owned U.S. subsidiary, named Yanolja US LLC, in Delaware in February, according to multiple local news reports.

According to the company’s first quarterly report, it disclosed Yanolja US LLC as consulting service provider.

The establishment of the Delaware subsidiary is part of the company’s attempt to go public on either the New York Stock Exchange or Nasdaq, according to reports.

Delaware is known for its business-friendly tax policies and corporate laws, making it a popular choice for major tech firms like Apple, Amazon and Alphabet especially when it comes to establishing a headquarters. Delaware is also the home state of the Nasdaq-listed Coupang.

SoftBank, the largest shareholder of Yanolja, might have influenced its decision to seek a listing in the U.S. market.

SoftBank injected around 2 trillion won ($1.45 billion) into the company with a mix of new and existing shares in 2021. SoftBank holds around 24.9 percent in Yanolja through its vision fund.

Yanolja used the fund to acquire Interpark in 2022, a measure to expand its market presence and diversify its business portfolio.

Many local reports previously estimated that a U.S. listing would likely extend Yanolja’s market capitalization to 10 trillion won.

Its market cap, however, currently stands at 2.8 trillion won.

Established in 2007, the travel platform swung to an operating profit of 14.9 billion won in the first quarter of this year, compared to an operating loss of 9.6 billion won in the same period a year ago.

BY CHOI HAE-JIN [choi.haejin@joongang.co.kr]